EMA12 and EMA26

Overlays EMA12 and EMA26

- Google Search: ema 12 ema 26 coinbase

- YouTube Search: Overlays EMA12 and EMA26

YouTube Videos Explaining Overlays EMA 12 & EMA 26

- 10:10 Moving average explained | EMA12 and EMA26 on Coinbase Pro – GDAX

- what is a moving average and how they are calculated

- A moving average is a general method of summarizing numerical values over time.

- OHLC – open, high, low, and closing values for each period

- Moving averages are combined with candlesticks to give us another value

- for each of these periods.

- In addition to OHLC values, with moving averages, we get an average for each period.

- This average is said to be moving, because it is calculated using a Sliding Window.

- Moving averages are calculated using a sliding window.

- When a new time period begins, the window slides forward, and a new candlestick is generated.

- The candlestick and average are both updated as new trades come in

- this is how the average moves over time

- each time we get a new candlestick, we get a new average value

Three things to Understand about Moving Averages

- What is the length of the window ?

- How are the values in the window averaged ?

- Which values in the window are averaged ?

- When we look at which values are averaged,

- we will also consider, how this summarizes the trade history.

We will use EMA12 for our discussion

- Everything we learn about EMA12 will apply to EMA26 and any other EMA

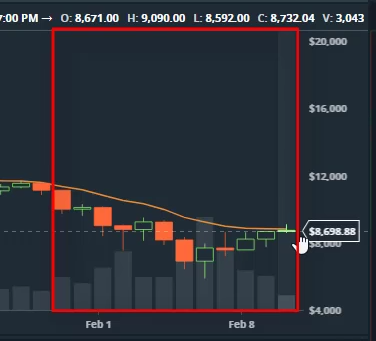

- He points to the Overlay button on the Trade screen,

- which then displays a submenu for EMA12 and EMA26

- He selects EMA12

- The first thing to notice is that the line is moving with the price.

- Even though the line is solid, the values are discrete

- Each candlestick now has an EMA12 value associated with it

- These values could be represented using dots, however we have a line.

- Think of this line as just connecting the dot at each candlestick

- At each candlestick the EMA12 value gives us an average price

- The 12 (in EMA12) tells us the length of the window used to calculate this average price

- The 12 reveals that the window starts at the current candlestick

- and moves back by 12 periods

- in this case, each period is one day, that you set on the Trade Screen

- We can call this moving average a 12 day moving average.

- If we had minutes selected for our period, you can call this a 12 minute moving average.

- The number and the name is the link of the window

- Other applications allow you to pick the length of the window

- Coinbase Pro only gives you the two windows of 12 and 26

- The 12 allows us to realize,

- that even though the price has been moving a lot over the last 12 days,

- it has roughly been around, whatever the average is for the EMA12.

- We don’t actually get a reading, we can just estimate

- so if we hoover (by moving the cursor to the first period)

- we can see that the average price of the last 12 days has been roughly 8,700 dollars

- When a new period begins, the last value in the window drops off,

- and a new value is added at the start of the window.

- All the while, there are always 12 values in the window

- so the 12th value will get taken out,

- and a new value will be added at the front of the window.

- This is how the average moves over time.

How the Values in the Window are Averaged

- Looking at the symbol EMA12,

- we know that the 12 describes the length of the window

- the MA means Moving Average – that tells us that there is a window

- the E stands for Exponential – this term tells us

- how the values in the window are averaged

- The normal average that most of us are use to, is a uniform average

- The Uniform Average is known as an SMA – Simple Moving Average

- that means that for every value in the calculation, has the same weight

- or influence on the average

- Example: SMA4: (v1)(.25) + (v2)(.25) + (v3)(.25) + (v4)(.25)

- Exponential Moving Averages provide a specific way of shifting the weight of the values.

- Exponential Moving Averages gives higher weight to values in the front of the window.

- This means that prices that have occurred more recently, get higher weight.

- Example: SMA4: (v1)(.25) + (v2)(.25) + (v3)(.25) + (v4)(.25)

- Example: EMA4: (v1)(.75) + (v2)(.10) + (v3)(.03) + (v4)(.02)

- This pulls the average in their direction when the calculation is performed.

Which Values Are Used in the Calculation

- We know that the values that have occurred more recently have more weight

- but which values are actually being used.

- It still might be that Coinbase doesn’t tell us this,

- but its safe to assume that the values being used, are the closing prices of each period

- OHLC (Open, High, Low, Closed)

- it’s the Closed value that they are using

- but its safe to assume that the values being used, are the closing prices of each period

- This is the convention when doing these calculations

- For our example, we are using the EMA12

- so we can start at the latest candlestick

- and find all the closing values going back by 12 candlesticks

- and this will give us the values that were used

- to calculate the EMA12 moving average

- Some platforms will give us the ability to use other values

- like the open, or the high or the low

- But the convention is to use the Close

A Review

- We now have enough knowledge to fully understand what EMA12 is telling us

- If we look at the EMA12 value at any candlestick,

- we know that this value gives us the average closing price

- starting at that candlestick and going back by 12 candlesticks

- We also know that the calculation is using exponential weighting

- which means more weight is given to more recent candlesticks

- before we conclude, I want to consider, what these facts mean,

- in terms of summarizing historical price action

- When we say historical price action, we are ultimately referring to the Trade History

- Note, the same Trade History panel from the Trade Screen

- Most of the time, we are looking at a candlestick chart, which means

- we are actually looking at the trade history, but a summary of the trade history

- And like what we have just seen, most moving averages

- are applied to closing prices of candlesticks

- The moving average is a summary of the candlesticks,

- which are a summary of the trade history

- This means that moving averages are losing further information

- about the actual trading activity.

- Moving averages use a single price, the closing price,

- for each time period in their calculation,

- even though there are many trades with varying prices in each period

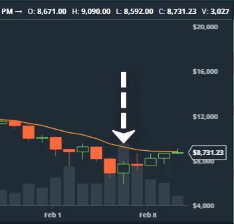

Moving Averages do not include Volume information

- Moving Averages also do not include volume

- which is a primary piece of information in the trade history.

- If we look at this candlestick for example,

- we can see that a relatively large number of bitcoins traded here

- as represented by the larger volume bar.

- But that has no effect on the moving average calculation.

- Only a single trade from this period,

- acted as a representative for the whole period in the moving average calculation.

This concludes our discussion of Moving Averages

- This concludes our discussion of moving averages

- and what information they are conveying.